Savor the Flavors: Bombay Beijing Fine Foods

Exploring the fusion of Indian and Chinese cuisines with delicious recipes and culinary tips.

Marketplace Liquidity Models: Navigating the Waves of Buyer and Seller Demand

Unlock the secrets of marketplace liquidity! Dive into dynamic models and master the ebb and flow of buyer and seller demand today!

Understanding the Basics of Marketplace Liquidity: Key Concepts and Terminology

Marketplace liquidity is a critical concept for anyone involved in trading, buying, or selling assets in various marketplaces, whether they are physical or digital. At its core, liquidity refers to how easily an asset can be bought or sold in the market without significantly affecting its price. A market with high liquidity allows for quick transactions and less price fluctuation, while a market with low liquidity can experience greater volatility. Understanding the basics of marketplace liquidity is essential for optimizing trading strategies and making informed investment decisions.

Several key terms are associated with marketplace liquidity that everyone should be familiar with:

- Market depth: This refers to the market's ability to sustain large orders without significant price changes, indicating the volume of buy and sell orders at various price levels.

- Bid-ask spread: The difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller will accept (the ask) is a strong indicator of liquidity.

- Order types: Various order types, such as market orders and limit orders, play a significant role in how transactions impact liquidity.

By understanding these fundamental concepts and terminology, one can better navigate the complexities of marketplace liquidity.

Counter-Strike is a highly popular first-person shooter game that has captivated millions of players worldwide. It involves two teams, terrorists and counter-terrorists, competing in various game modes to complete objectives or eliminate the opposing team. Players often look for ways to enhance their experience, and using tools like daddyskins promo code can provide valuable skins and gear. With its competitive scenes and constant updates, Counter-Strike remains a staple in the gaming community.

How Buyer and Seller Demand Fluctuates: A Deep Dive into Marketplace Dynamics

The dynamics between buyer and seller demand are critical factors that influence marketplace trends. At any given moment, various elements can cause fluctuations in demand, which can be driven by changes in consumer behavior, economic conditions, or even seasonal patterns. For instance, during holiday seasons, buyer demand typically surges, prompting sellers to adjust their strategies to capitalize on this increase. On the other hand, during economic downturns, buyer confidence may wane, leading to reduced demand and prompting sellers to reconsider their pricing and promotional tactics.

Understanding how these fluctuations occur is essential for businesses looking to optimize their presence in the marketplace. Demand elasticity, which refers to how sensitive buyers are to changes in price, plays a vital role in this process. If demand is elastic, minor price decreases can significantly boost sales volume. Conversely, when demand is inelastic, sellers have more flexibility to increase prices without losing customers. By analyzing market data and consumer trends, businesses can better navigate the complex interplay of buyer and seller demand, ensuring they remain competitive and responsive to changing conditions.

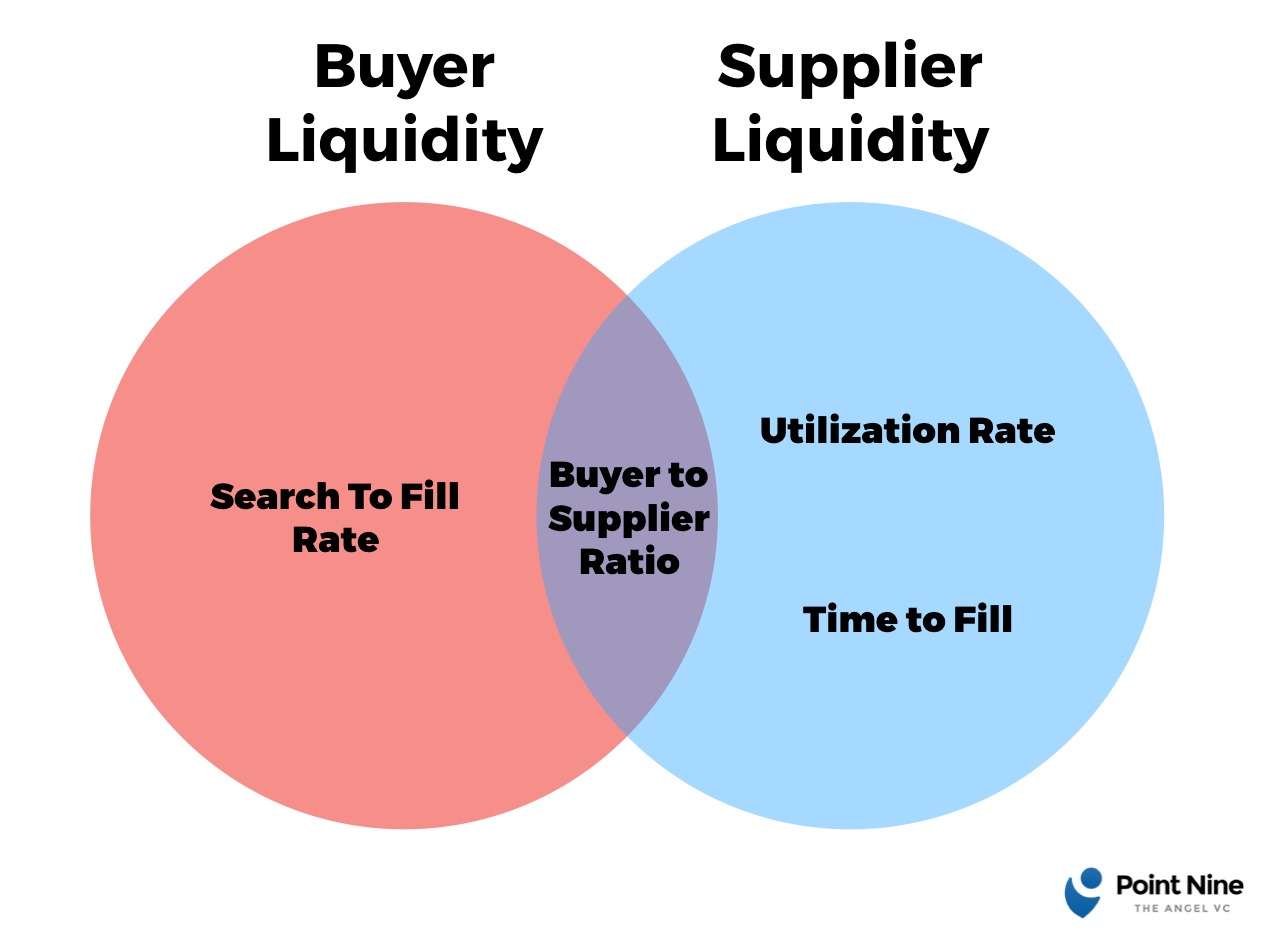

What Factors Influence Liquidity in Online Marketplaces?

Liquidity in online marketplaces is influenced by several factors that can significantly affect the ease with which assets can be bought and sold. Firstly, the number of participants in a marketplace often dictates its liquidity. A larger pool of buyers and sellers generally enhances liquidity, allowing for quicker transactions and lower price volatility. Additionally, the types of assets being traded play a crucial role; for instance, standard products with high demand tend to have better liquidity compared to niche items. Other elements include the transaction speed and ease of use of the platform, which can attract more users and foster a healthy trading environment.

Another key factor influencing liquidity is market structure. In an online marketplace, the presence of transparent pricing and reliable information can help participants make informed decisions, thus enhancing trading volumes. Furthermore, external influences—such as economic conditions, regulatory changes, and technological advancements—can also impact liquidity levels. For example, during economic downturns, market confidence may wane, leading to reduced participation and, consequently, lower liquidity. Understanding these dynamics is crucial for both buyers and sellers looking to maximize their experience and success in any online marketplace.